cryptocurrency tax calculator australia

Were here to help you. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800.

Crypto Tax In Australia The Definitive 2021 2022 Guide

Selling cryptocurrency for fiat currency eg.

. CoinTracking is the best crypto tax software for Australian traders making it easy to import all your trades from 110 exchangeswallets including DeFi and. The world of cryptocurrency and taxation is a murky one. ATO Tax Reports in Under 10 mins.

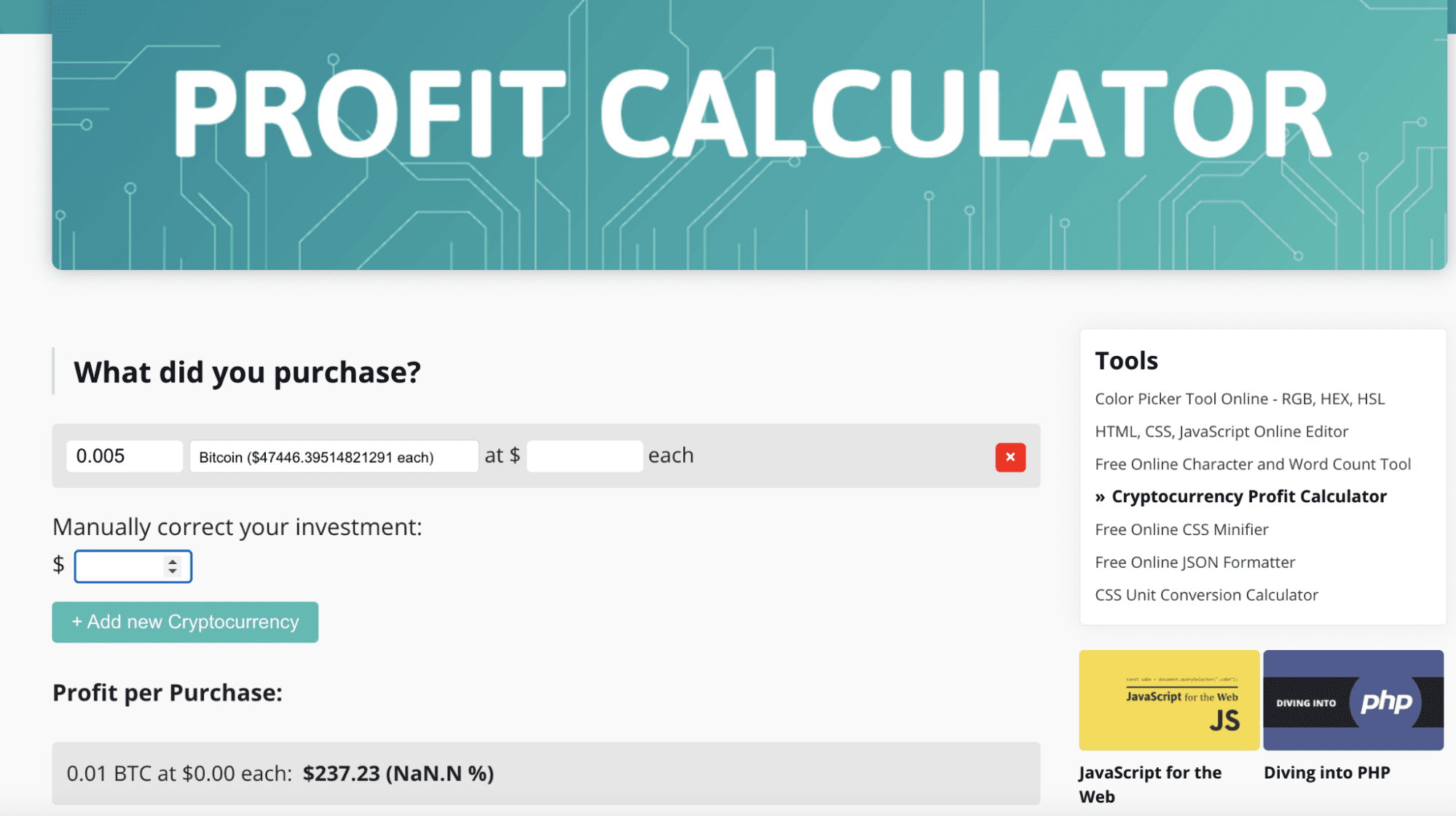

To calculate your capital gains you can take the cost of the Bitcoin in AUD at time of purchase and subtract that from the proceeds you made at the time of sale in order to calculate your profit or loss. 50 Capital Gains Tax discount. Australian Dollars triggers capital gains tax.

This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. If you hold your cryptocurrency for more than a year before selling or trading it you may be entitled to a 50 CGT discount. The resulting number is your cost basis 10000 1000 10.

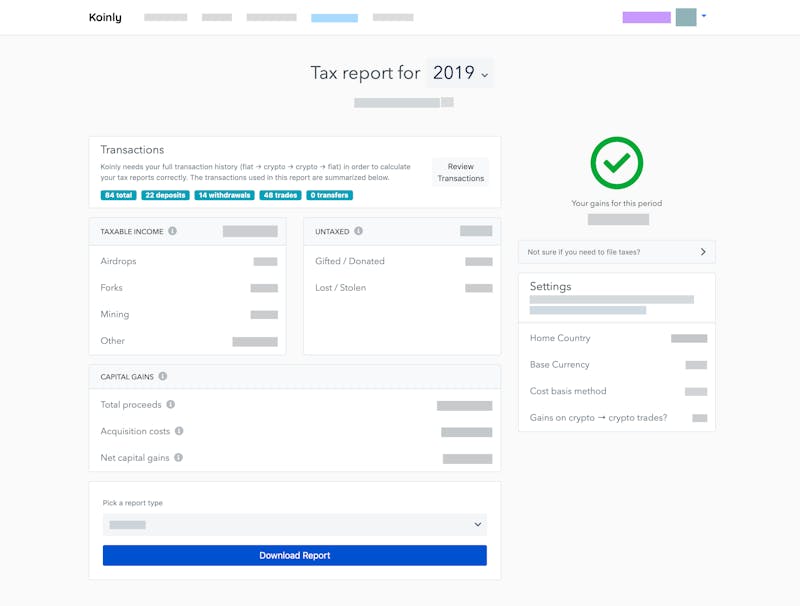

If youve been trading cryptocurrencies on Binance Australia or participating in other cryptocurrency-related activities in the last financial year you may have an obligation to report your activities in your next tax return. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. Download your completed IRS forms to file yourself send to your accountant or import into software like TurboTax and TaxAct.

There are four simple steps which I will go through in detail below. Let Koinly calculate your crypto taxes. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain.

Crypto Tax Calculator for Australia. Heres an example of how to calculate the cost basis of your cryptocurrency. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

Transfer AUD from PayPal into your crypto account. How to file crypto taxes Get help with your crypto tax reports. Yes the Australian Tax Agency ATO has issued official guidance stating that cryptocurrency is taxed as a capital gains asset which means you have to pay tax every time you trade sell or use crypto to pay for goodsitems.

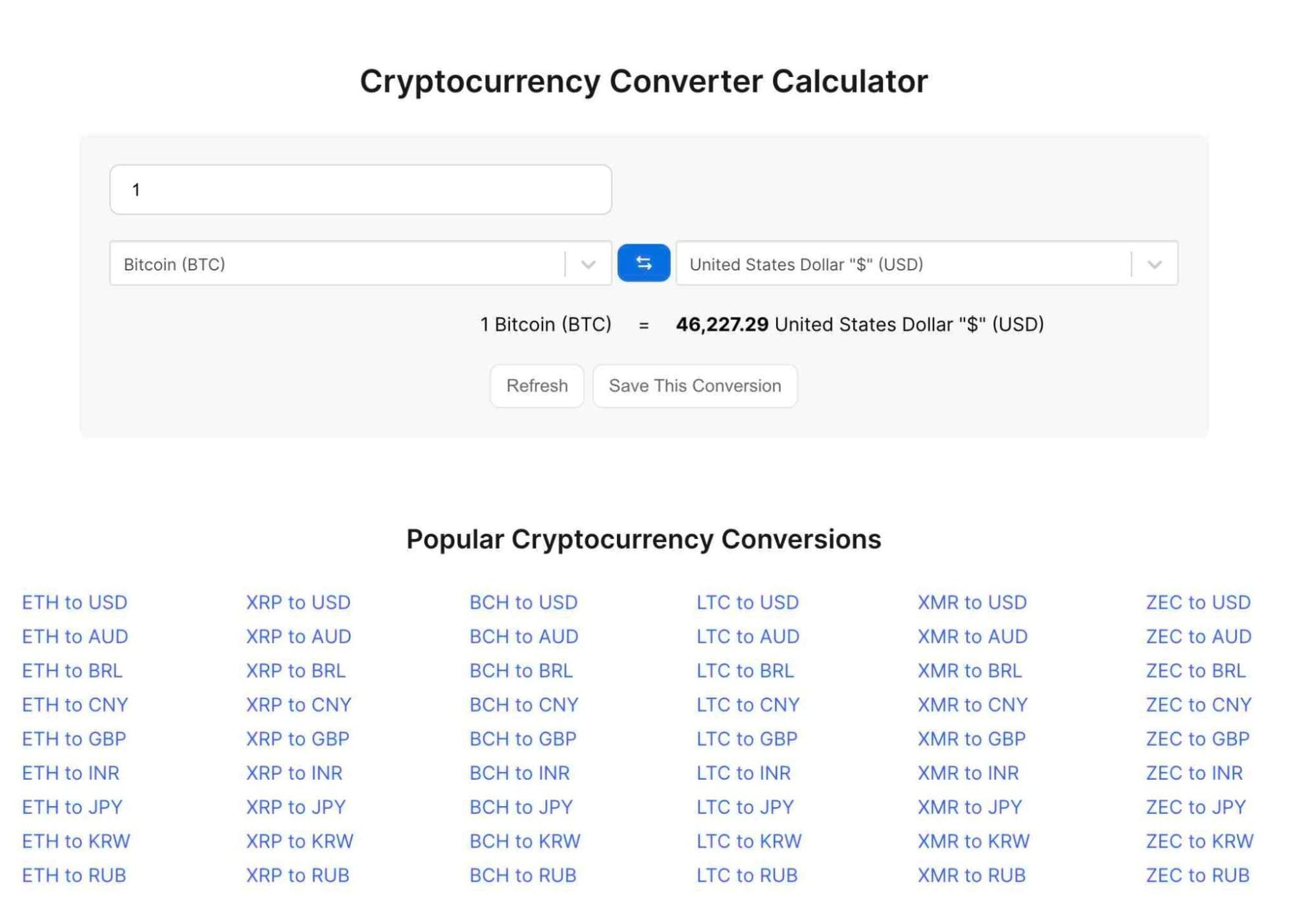

Sally records a gain of 1000 and still has. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. At Etax we want to help you understand how cryptocurrency investments are taxed so we put together.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Income - Tradings GainsLosses Deductions. You can discuss tax scenarios with your accountant.

Hold for more than 12 months. If he were to sell his BTC and cash out he would have to pay taxes on A7000 A12000 A5000 of capital gains. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly.

It provides users with an extremely user-friendly app which can be connected to all of their exchange platform accounts to seamlessly pull all the necessary transaction history data needed to get an accurate overview of the users tax slots. Partnered with the largest tax preparation platform to make it easy for you to E-File your crypto gains and losses with your full tax return. Quick simple reliable.

Two things in life are certain. You simply import all your transaction history and export your report. TokenTax is a crypto tax management company that was founded by Alex Miles back in 2017.

10 common faqs on crypto tax in australia. 0325 5000 1625. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

Crypto tax calculator australia. For it brilliant data analyzing ability it won the Product Hunt Global Hackathon in 2017. TokenTax works as a cryptocurrency tax calculator that connects to every crypto exchange.

For cryptocurrency traders the formula differs a bit. Sally buys 2 BTC on Monday for 5000 each. Sally sells 1 BTC on Wednesday for 6000.

In our Australian crypto tax guide we break down everything you need to know about crypto taxes including what you need to provide when you lodge your crypto tax return with Etax. 49 per tax season. Australian Crypto Tax Calculator.

1 BTC is now worth A12000. If you held your. Janes estimated capital gains tax on her crypto asset sale is 1625.

Take the initial investment amount lets assume it is 1000. Cryptocurrency generally operates independently of. Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web.

While taxes can be deathly dull they dont have to. Youll only start to pay Income Tax when you hit 18200 in total income per year. For example lets say Sam bought 1 bitcoin BTC for A5000 five years ago.

This platform directly imports data from crypto wallet merchants. The tax rate on this particular bracket is 325. Find out all the details about cryptocurrency tax in Australia from buying and selling crypto to all the tax reporting requirements.

Welcome to the best crypto tax calculator application in Australia. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. We cover how to calculate your taxes how to minimize your capital gains and what is required to be reported by the Australian Tax Office.

Plus some tips on how to make your life easier at tax time. If your cryptocurrency trades are conducted through a company registered with ASIC your tax rate is 275 of all business-related income. Convert cryptocurrency to fiat currency a currency established by government regulation or law such as australian dollars or.

Cryptocurrency generally operates independently of a central bank central authority or government. You will also learn how to generate and file your crypto tax. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king.

Updated on December 28 2020. In this guide you will learn everything you need to know about bitcoin and cryptocurrency taxation in Australia. Tax treatment of cryptocurrencies.

If youre classed as a cryptocurrency investor youll be taxed on any capital gains resulting from your crypto transactions.

Best Cryptocurrency Calculator Mining Profit Taxes

Pin By Keli Joie On Quick Saves In 2022 Option Trading How To Introduce Yourself Bitcoin Value

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Review Of 6 Crypto Tax Software Packages

Bitcoin Price Prediction Today Usd Authentic For 2025

Btc To Aud Price Converter Sell Bitcoin For Australian Dollars Bitcoin Price Bitcoin Cryptocurrency

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Best Cryptocurrency Calculator Mining Profit Taxes

Adaugă Pin Pe Idea Inspiration

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency

How To Calculate Crypto Taxes Koinly

How We Started A 20k Month Online Store That Sells Australian Handmade Gifts Starter Story Corporate Stationery Business Stationery Business

Cryptocurrency Tax Reports In Minutes Koinly

Koinly Crypto Tax Calculator For Australia Nz

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin