salt tax limit repeal

Senate Budget Committee chair Bernie Sanders will include a partial repeal of the Tax Cut and Jobs Acts 10000 cap on the. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus.

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

The higher SALT deduction limit would be financed by an increase in the top marginal income tax rate from 37 to 396 the rate that existed before passage of the 2017.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. A new bill seeks to repeal the 10000 cap on state and local tax deductions. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

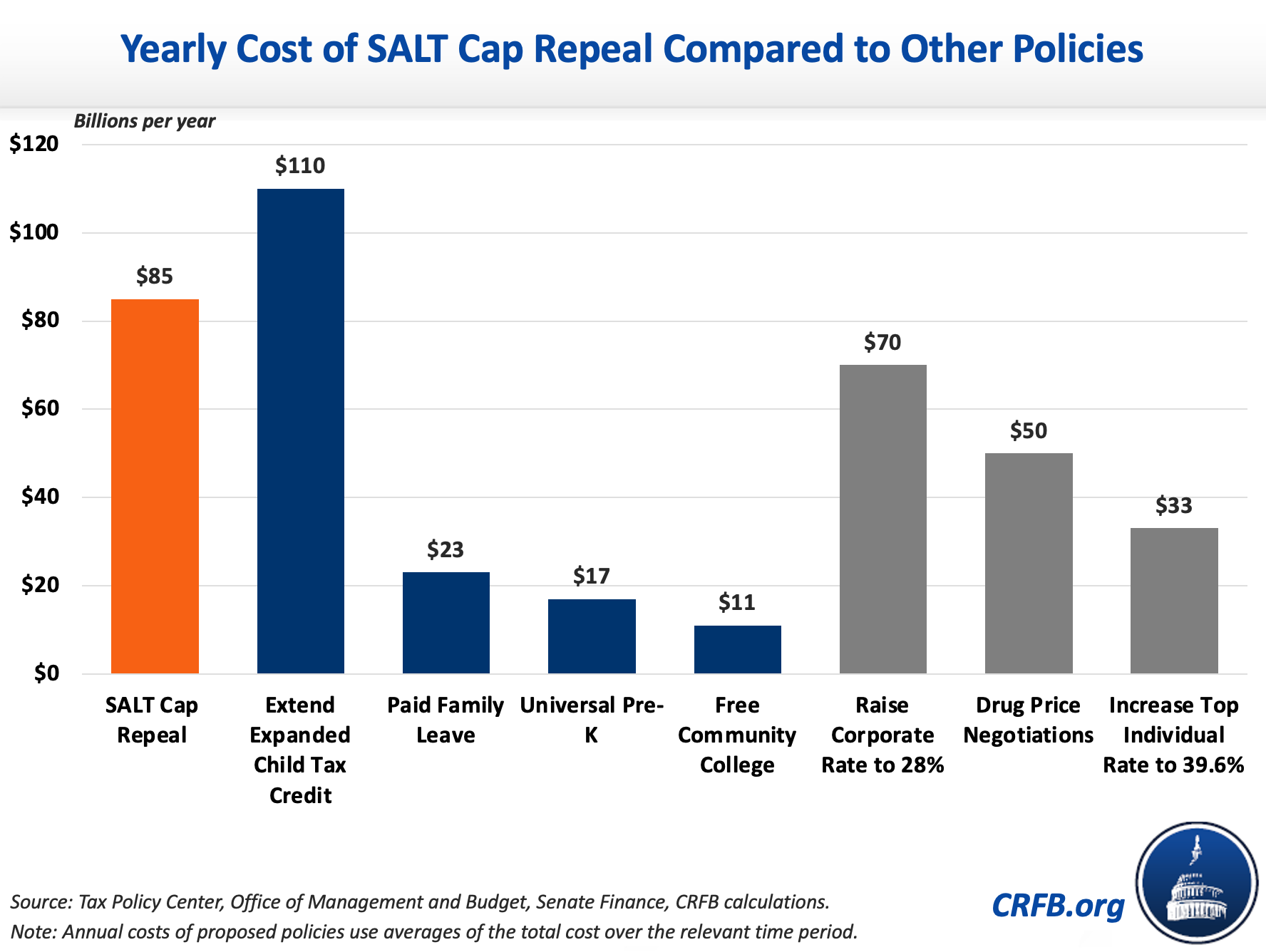

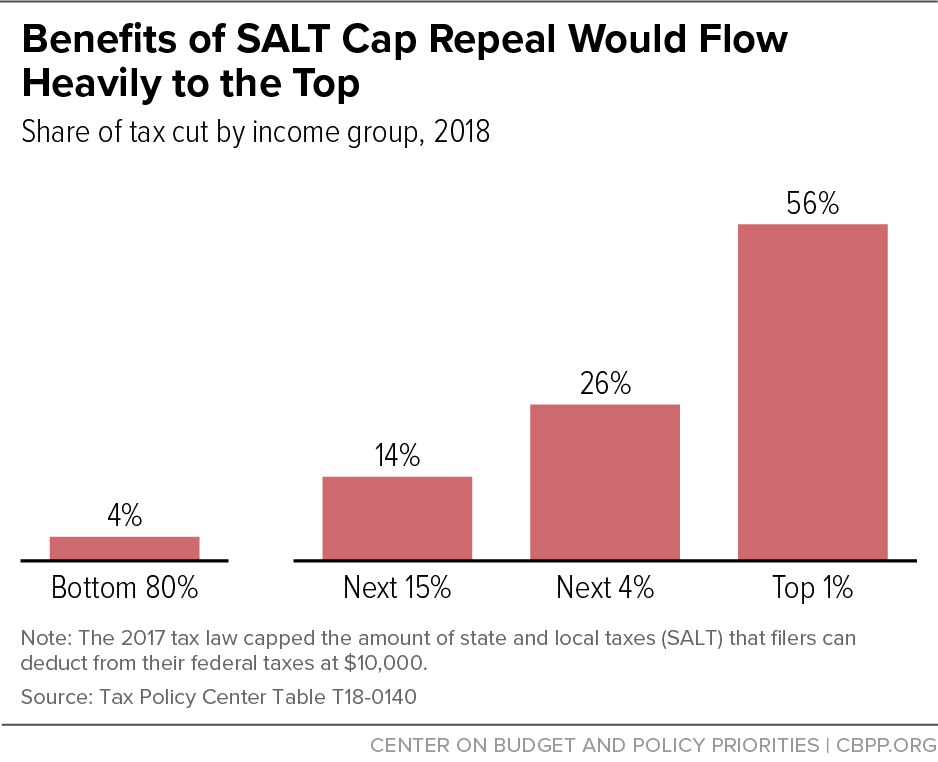

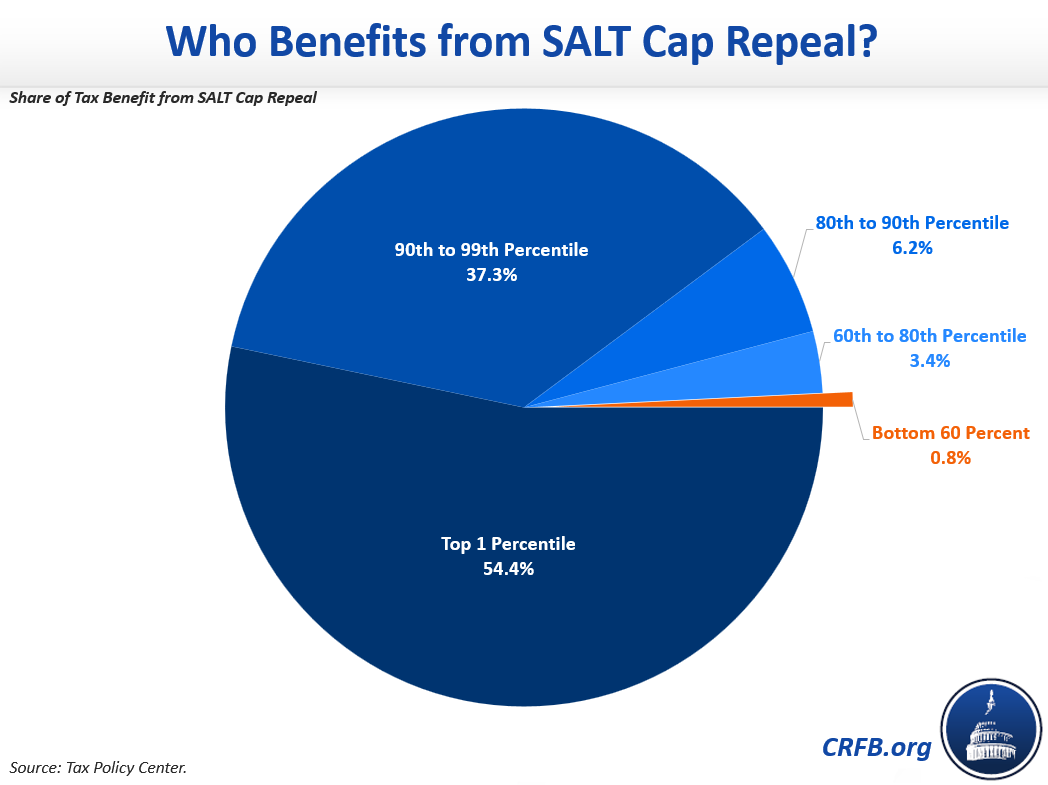

After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for the partys. The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. 54 rows The value of the SALT deduction as a percentage of adjusted gross.

For your 2021 taxes which youll file in 2022 you can only itemize when your. Democrats are angling to repeal a Trump-era limit on state and local tax deductions as part of President Bidens signature spending plan but a new analysis shows how. Expansion of SALT Cap Workaround SB.

The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats. Americans who rely on the state and local tax SALT deduction. Sanders would partially repeal the SALT cap.

The TCJA also repealed the Pease limitation for tax years 2018 through 2025. Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value. The Tax Cuts and Jobs Act TCJA enacted in December 2017 limited the itemized deduction for state and local taxes to 5000 for a married person filing a separate.

Raising or repealing the 10000 limit on the SALT deduction a change imposed by the 2017 Republican tax overhaul is one of the most politically charged aspects of the. The change may be significant for filers who itemize deductions in. March 1 2022 600 AM 5 min read.

GOP lawmakers imposed the deduction cap in 2017 with the passage of the Tax Cuts and Jobs Act which slashed the corporate tax rate to 21 and cut individual income. Supreme Court has rejected a challenge to overturn the 10000 limit on the federal deduction for state and local taxes which is known as SALT. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Benefits Of Salt Cap Repeal Would Flow Heavily To The Top Center On Budget And Policy Priorities

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Salt Deduction Resources Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress